With the rising cost of living, budgets are tighter than ever. The recent interest rate rises in Australia have exacerbated the issue (with more expected to come) and understandably, some of us may be a little nervous. We spoke to MyBudget Loans Head of Lending Cade McMurtrie to get an idea of Australia’s interest rate rise journey and what Australians can do to prepare.

When will interest rates rise in Australia?

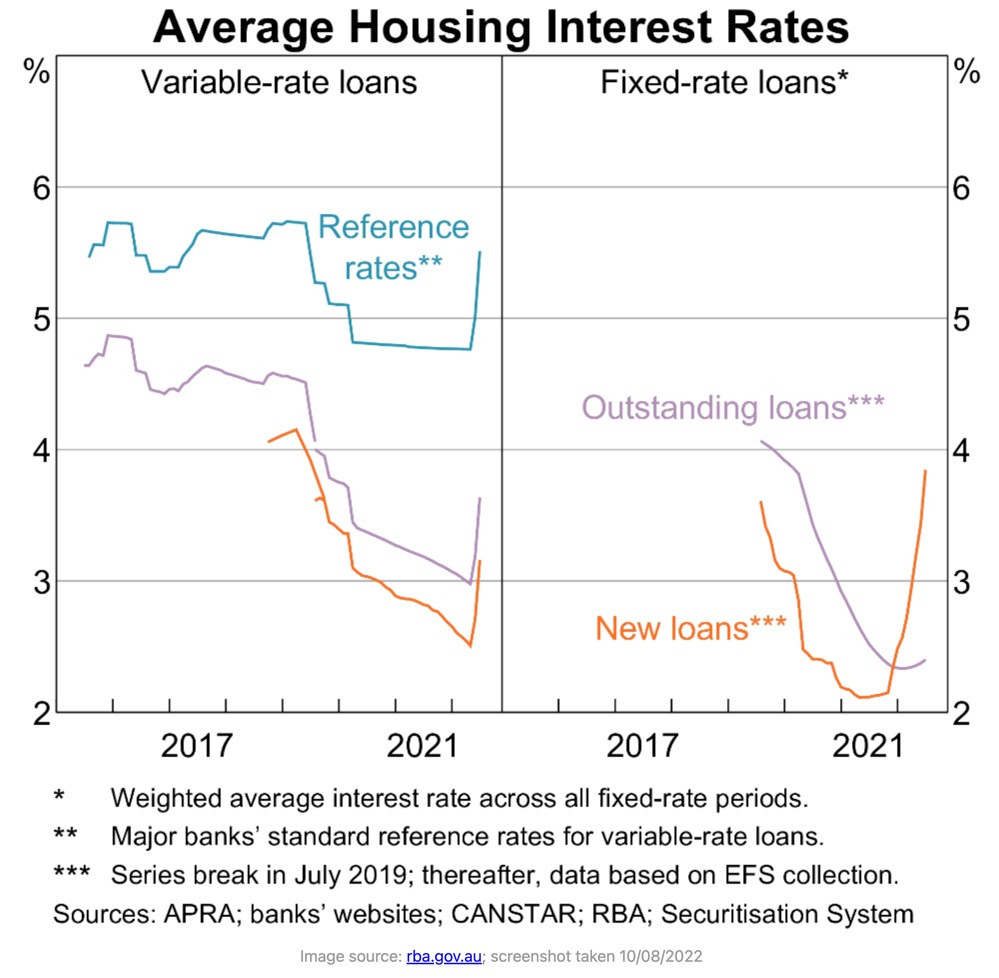

For the first time in over 11 years, Australia’s interest rates are on the rise. According to the Reserve Bank of Australia (RBA), there are likely to be further interest rate rises to come in an attempt to flatten the curve of inflation. The first four interest rate rises have taken place monthly from May to August (with more expected to follow), and with a cash rate rise as a result to 1.85%, this leaves homeowners with a degree of angst as it is likely to go up even further.

In practical terms, how will an interest rate rise likely affect Australians?

With a 2.5% interest rise, that’s $2500 per year for every $100,000 owing on a home loan and according to Canstar, the average (mean) home loan on a newly built house is $574,755. Therefore, a total 2.5% interest rate rise over 12 months would equate to a whopping $14,368.88 more per year than the average Australian newly built home owner had allocated to mortgage repayments in their budget.

And when you consider this additional cost alongside the rising cost of groceries, petrol and other regular expenses, the picture that’s being painted is certainly becoming bleaker.

Does this make it more difficult for first homeowners who took advantage of recent grants?

Not necessarily. However, situations may have changed since purchasing a home (e.g. going from double to single income, starting a family, change in employment, etc.), therefore this may put further strain on their situation if they are beginning to struggle.

Those who opted in for first home owner grants may also have a higher-than-average interest rate. Conducting a home loan health check might be a good way to assess whether you may be in a position to refinance your mortgage to save on interest and find savings.

What can homeowners do to prepare?

Spring cleaning your finances is a great way to find ways to save money. Creating a checklist and testing new figures in your budget is the perfect way to pre-empt the changes so you’re not stressing later. This is the perfect opportunity to do some budget spring cleaning by ensuring that every dollar is being put to good use.

Things like updating your phone plan, checking your insurance, unsubscribing from services you don’t use anymore, shopping online, and planning your meals. All of the little things add up and you may find yourself in a better position once all is said and done. A budget is the best way to proactively tackle interest rate rises and the increased cost of living. There’s no better time to start than right now.

Should people be looking to refinance their mortgages now or after the rise?

Refinancing before interest rates rise any more may alleviate some financial pressure. And besides, it never hurts to be prepared and ahead of the game.

MyBudget Loans on average can save MyBudget clients $7000 a year by refinancing their home loans and even find opportunities to also refinance credit cards and personal loans.

If you find yourself a little concerned about rising interest rates and worrying about how you’ll be able to navigate through, you’re not alone. Everyone's financial position is unique and so having a customized budget plan tailored to suit your circumstances makes a world of difference.