FOR IMMEDIATE RELEASE

ADELAIDE, AUSTRALIA - June 24, 2024 - MyBudget, Australia's leading personal finance company, today released a comprehensive analysis of the 2024 tax cuts, offering strategic insights to help Australians maximize their financial benefits. The analysis comes in response to the recent federal budget announcement, which introduces significant changes to the tax system starting July 1, 2024.

Understanding the 2024 Tax Cuts: An Overview

The 2024 tax cuts represent a substantial shift in Australia's tax landscape, designed to provide relief to workers across various income brackets. Tammy Barton, Founder and Director of MyBudget, stated, "These tax cuts present a unique opportunity for Australians to reassess their financial strategies and potentially improve their long-term financial health."The new tax structure includes reductions in tax rates and adjustments to income thresholds. The 19% tax rate will decrease to 16%, while the 32.5% rate will drop to 30%. Additionally, the income threshold for the 37% tax rate will increase from $120,000 to $135,000, and the 45% tax rate threshold will rise from $180,000 to $190,000.

Key Changes in the 2024 Tax Rates: What You Need to Know

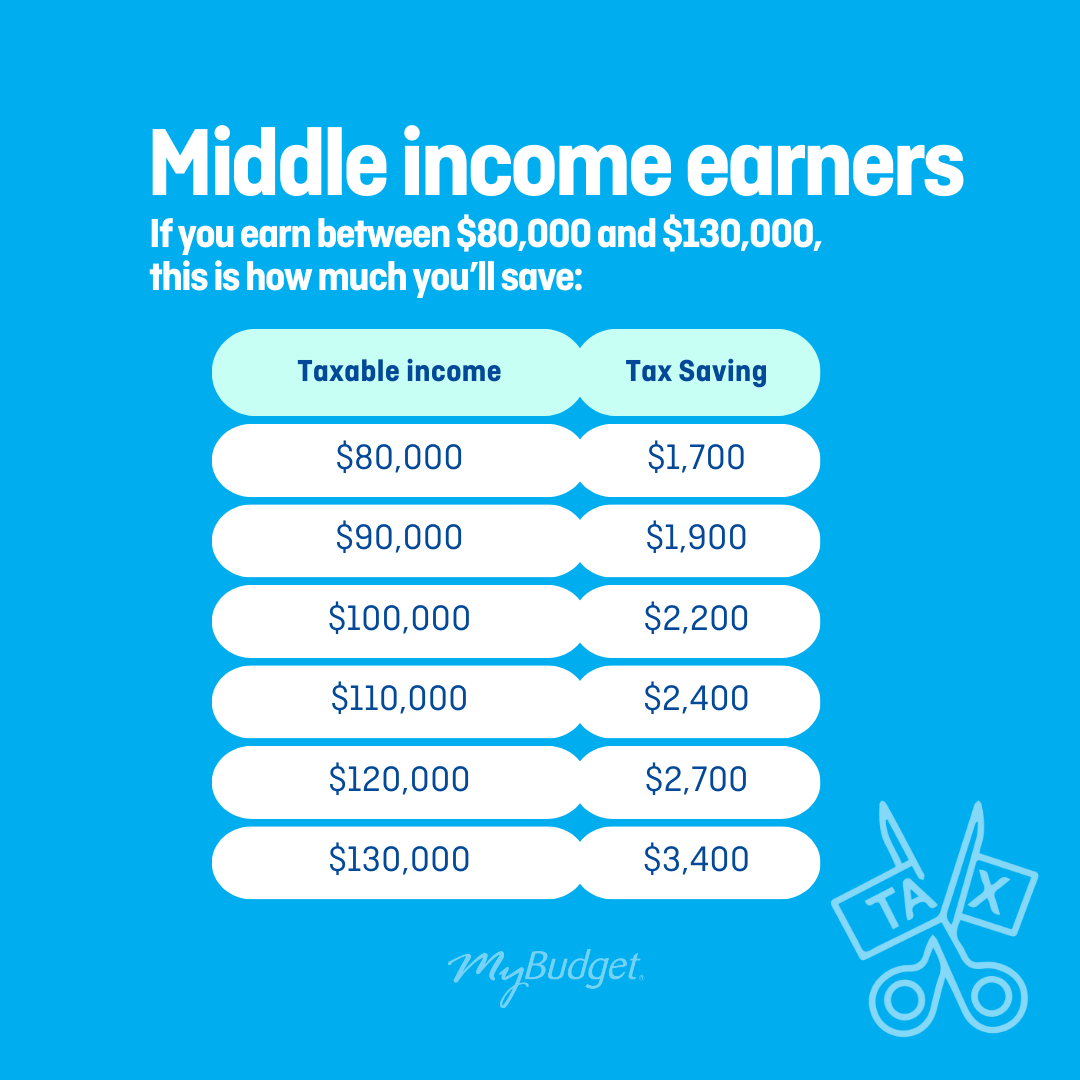

The impact of these changes varies across income levels. MyBudget's analysis reveals that an Australian worker earning $40,000 annually will receive a tax relief of $654. For those with an average income of $73,000, the benefit increases to $1,504 per year. Higher earners are also set to benefit, with individuals earning $100,000 enjoying a tax reduction of $2,179, and even those at the $200,000 income level receiving a cash savings of $4,529.Ms. Barton emphasized, "Understanding these changes is crucial for effective financial planning. We encourage all Australians to use the government's Tax Cut Calculator to determine their specific benefits and plan accordingly."

How the New Tax Rates Can Lead to Significant Savings

The potential for savings under the new tax rates is substantial. MyBudget's analysis indicates that middle-income earners stand to gain the most significant benefits. However, the company stresses that the real value of these tax cuts lies in how individuals choose to utilize the additional funds."While the immediate relief is welcome, the long-term impact of these tax cuts depends on strategic financial management," Ms. Barton explained. "Our goal at MyBudget is to help Australians leverage these savings to improve their overall financial position, rather than succumbing to lifestyle inflation."

MyBudget's Detailed Analysis: Maximizing Your Tax Benefits

MyBudget has developed a comprehensive strategy to help Australians maximize the benefits of the 2024 tax cuts. The company's approach focuses on five key areas:

- Allocating tax savings to cover daily expenses

- Paying off high-interest debt

- Boosting emergency savings

- Investing for long-term growth

- Upskilling and personal development

Each strategy is designed to address different aspects of financial health, from immediate cost-of-living relief to long-term wealth building.

Strategic Tax Planning: Tips for Leveraging the 2024 Tax Cuts

MyBudget's analysis emphasizes the importance of strategic planning in maximizing the benefits of the tax cuts. The company recommends setting up separate high-interest savings accounts for specific purposes, such as emergency funds or bill payments.For those with high-interest debt, MyBudget suggests prioritizing debt repayment. "By directing tax savings towards high-interest debt, individuals can significantly reduce their overall interest payments and accelerate their journey to financial freedom," Ms. Barton noted.The company also highlights the potential of investing tax savings for long-term growth. While acknowledging the importance of thorough research and professional advice, MyBudget points out that even small, regular investments can compound over time to create substantial wealth.

Common Pitfalls to Avoid When Navigating the New Tax Rates

MyBudget's analysis also identifies potential pitfalls that Australians should be aware of when managing their tax cuts. The company warns against the temptation to increase discretionary spending, which could negate the benefits of the tax relief.Another common mistake is failing to adjust withholding rates with employers. MyBudget advises individuals to ensure their employers are aware of the new tax rates to avoid over-withholding throughout the year.The company also cautions against neglecting long-term financial planning in favor of short-term gains. "While the immediate relief is welcome, it's crucial to consider how these tax cuts can contribute to your long-term financial goals," Ms. Barton stated.

Future-Proofing Your Finances: Long-Term Benefits of the 2024 Tax Cuts

Looking beyond the immediate impact, MyBudget's analysis explores the potential long-term benefits of the 2024 tax cuts. The company suggests that, when managed strategically, these tax savings could contribute significantly to retirement savings, home ownership goals, or funding education.Ms. Barton concluded, "The 2024 tax cuts represent more than just immediate financial relief. They offer a unique opportunity for Australians to reassess and strengthen their financial foundations.

MyBudget encourages all Australians to take a proactive approach to their finances in light of these tax changes. The company offers personalized budgeting services and financial coaching to help individuals navigate these changes and optimize their financial strategies.

About MyBudget:

Founded in 1999 by Tammy Barton, MyBudget is Australia's leading personal budgeting service. The company has helped over 130,000 Australians take control of their finances through personalized budgeting plans, debt reduction strategies, and financial education. MyBudget's mission is to reduce financial stress and empower individuals to achieve their financial goals.